Why Emergency Funds Save More Than Just Money

The Psychological Impact of Having Emergency Funds

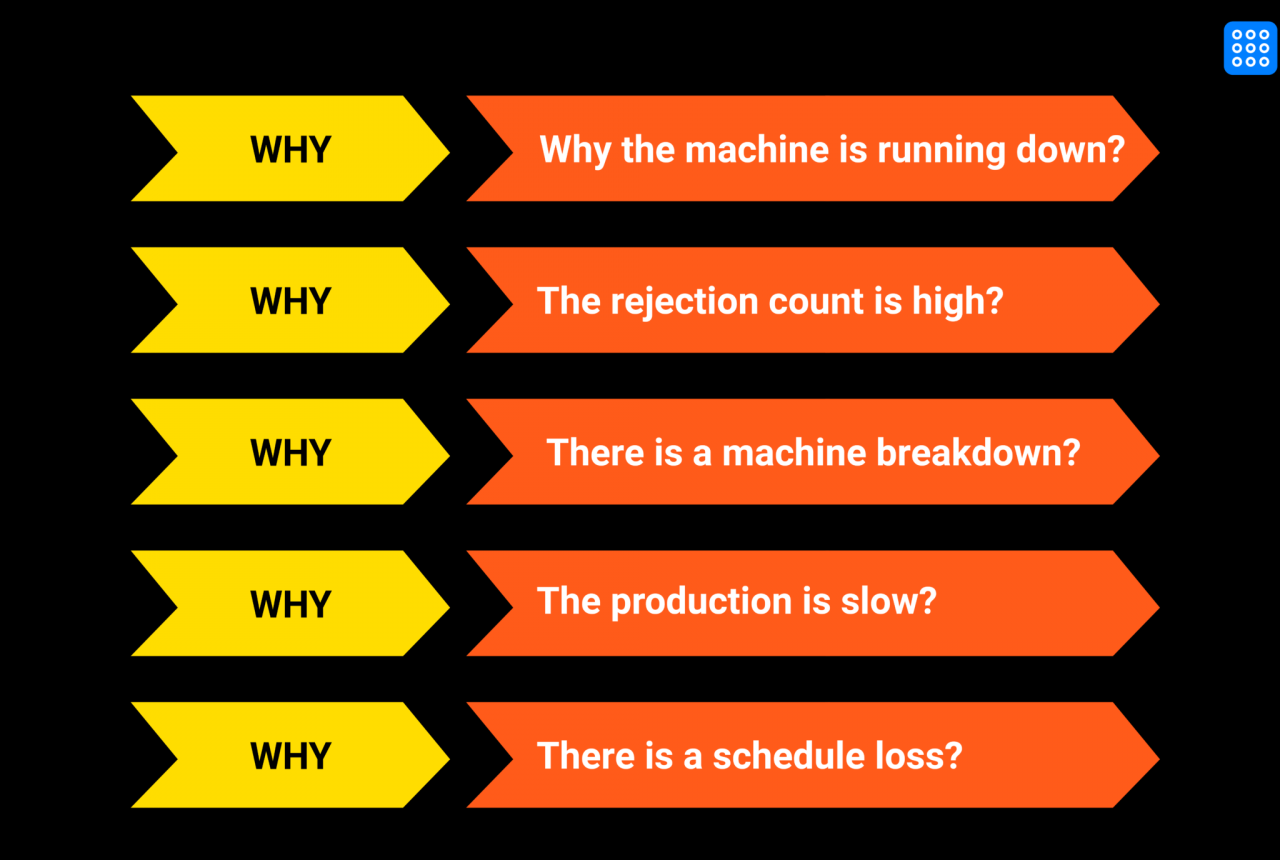

Source: fogwing.io

Having a readily available emergency fund isn’t just about financial security; it significantly impacts your mental well-being. This buffer of savings provides a crucial sense of peace of mind, allowing you to navigate unexpected life events with greater resilience and less stress. This psychological benefit is often overlooked but plays a vital role in overall financial health.

Having a substantial emergency fund translates into a profound feeling of security and control. Knowing you have a financial safety net alleviates the constant worry about unforeseen circumstances, fostering a sense of calm and confidence in your ability to handle challenges. This security extends beyond mere financial stability; it translates into a more relaxed and positive outlook on daily life. This peace of mind influences decisions, enabling you to focus on achieving your long-term goals without the constant pressure of immediate financial anxieties.

The Alleviation of Financial Anxiety

Financial anxieties can significantly impact mental health and daily life. These anxieties manifest in increased stress, worry, and reduced ability to focus on other aspects of life. The constant fear of financial hardship can lead to sleepless nights, strained relationships, and decreased productivity. An emergency fund acts as a powerful antidote to these anxieties, offering a tangible solution to potential financial crises.

Examples of the Absence of an Emergency Fund

Consider a scenario where a family experiences a sudden, unexpected car repair bill. Without an emergency fund, the resulting financial strain can lead to significant stress and worry. The family might face difficult choices, such as delaying essential medical care or jeopardizing their children’s education. These types of unexpected events, while unavoidable, can be significantly less disruptive when a safety net is in place.

Impact on Decision-Making

An emergency fund can dramatically improve decision-making. Knowing you have financial security reduces the pressure to make hasty or ill-advised choices in the face of an emergency. This allows you to carefully consider all options and make decisions that best align with your long-term goals. Without an emergency fund, individuals may be compelled to take on high-interest loans or make other financially risky decisions, which can lead to further complications.

Emergency Fund Adequacy and Psychological Impact

| Fund Amount | Perceived Security | Stress Levels | Impact on Decisions |

|---|---|---|---|

| Low (e.g., less than 3 months of living expenses) | Moderate; some anxiety remains | High; frequent worry about finances | Decisions influenced by immediate financial needs, potentially leading to impulsive choices |

| Moderate (e.g., 3-6 months of living expenses) | High; significant sense of security | Low; occasional anxieties, but generally calm | Decisions based on long-term goals, with less pressure to make immediate financial sacrifices |

| High (e.g., 6+ months of living expenses) | Very High; strong sense of control and confidence | Very Low; minimal financial anxieties | Decisions aligned with long-term financial objectives, with freedom to prioritize personal and professional growth |

Financial Stability and Resilience

Having an emergency fund acts as a crucial safety net, bolstering financial stability and resilience in the face of unexpected events. This preparedness allows individuals to navigate challenging times with less stress and greater control over their financial future. The presence of an emergency fund provides a buffer against financial shocks, preventing them from escalating into long-term crises.

Understanding how emergency funds enhance financial resilience is essential for making informed financial decisions. A robust emergency fund provides a financial cushion, allowing individuals to weather unforeseen circumstances without resorting to high-interest debt or compromising their long-term financial goals. This proactive approach reduces the risk of accumulating significant debt and promotes a more stable financial trajectory.

Navigating Unexpected Events

An emergency fund equips individuals to handle unexpected events like job loss, medical emergencies, or car repairs without significant financial hardship. This proactive approach to financial planning allows for greater peace of mind and reduced stress during times of uncertainty. Individuals with sufficient emergency funds are better positioned to address these events without incurring significant debt or disrupting their financial stability. This proactive planning reduces the risk of falling into a cycle of debt and promotes a more stable financial future.

Comparing Financial Outcomes

Individuals with emergency funds typically experience less financial stress and more control during challenging times compared to those without. The availability of readily accessible funds minimizes the need for immediate borrowing or selling assets at unfavorable prices. This stability allows for a more rational and measured approach to problem-solving, promoting a more positive financial trajectory. For example, during a job loss, individuals with an emergency fund can focus on finding new employment rather than being overwhelmed by immediate financial pressures. Conversely, individuals without an emergency fund often face immediate financial hardship, leading to potentially detrimental decisions and long-term financial instability.

Mitigation of Unexpected Events

| Event | Potential Impact | Mitigation by Emergency Fund | Alternative Solutions |

|---|---|---|---|

| Job Loss | Loss of income, potential for rent/mortgage arrears, inability to meet essential expenses. | Emergency funds provide a cushion to cover living expenses during the job search period, avoiding mounting debt. | Seeking unemployment benefits, exploring part-time work, seeking assistance from family/friends. |

| Major Medical Emergency | High medical bills, potential for loss of income due to time off work, significant financial strain. | Emergency funds cover medical expenses and lost income, preventing the need for high-interest debt. | Exploring insurance options, negotiating payment plans with healthcare providers. |

| Major Home Repair | Unforeseen costs associated with repairs, potential for significant financial burden. | Emergency funds provide a means to address home repair needs without resorting to debt. | Exploring home improvement loans, seeking assistance from family/friends. |

| Car Breakdown/Repair | Unexpected expenses for car repair, potential for transportation issues and additional costs, impact on ability to commute to work. | Emergency funds cover unexpected car repair expenses, preventing delays in transportation. | Seeking loans for car repairs, exploring alternative transportation options. |

Beyond Monetary Value

Source: blogspot.com

Having a robust emergency fund offers far more than just financial security; it cultivates a sense of empowerment and control over one’s financial future. This proactive approach fosters a positive feedback loop, enabling calculated risks and investments that might otherwise remain unattainable.

Beyond the immediate relief from financial stress, an emergency fund significantly impacts an individual’s overall well-being. The knowledge of having a safety net fosters a sense of freedom and confidence, allowing individuals to approach life’s challenges with a more resilient attitude. This, in turn, paves the way for personal growth and the pursuit of ambitions without the constant fear of financial setbacks.

Sense of Control and Empowerment

An emergency fund provides a tangible sense of control over one’s financial destiny. Knowing that you have a financial cushion during unexpected circumstances eliminates the constant anxiety and stress associated with financial instability. This sense of security translates into a greater sense of empowerment, allowing individuals to make decisions based on their needs and aspirations rather than being dictated by financial constraints. This freedom from financial worries is invaluable for personal growth and development.

Calculated Risks and Investment Opportunities

Financial security allows individuals to take calculated risks and explore investment opportunities that might otherwise be out of reach. Without the fear of jeopardizing essential living expenses, individuals can allocate resources towards ventures that have the potential for higher returns. This calculated approach is often crucial for long-term financial growth and can lead to significant improvements in financial well-being. For example, someone with an emergency fund might feel more comfortable investing in the stock market, pursuing entrepreneurial ventures, or even making a larger down payment on a home, opportunities often unavailable to those without such a safety net.

Impact on Personal Growth and Confidence

Financial stability significantly impacts personal growth and confidence. Knowing that you can handle unexpected expenses without sacrificing essential needs fosters a sense of resilience and self-reliance. This, in turn, builds confidence in managing personal finances and making informed decisions. Individuals with a strong financial foundation often report feeling more confident in their ability to achieve their personal and professional goals.

Pursuing Personal Goals and Ambitions, Why Emergency Funds Save More Than Just Money

An emergency fund empowers individuals to pursue personal goals and ambitions without the constraint of financial limitations. The ability to focus on long-term aspirations without the constant worry of immediate financial needs leads to greater fulfillment and a more enriching life. This is particularly crucial for individuals pursuing higher education, starting a business, or making significant life changes. For instance, an emergency fund allows someone to quit a job and pursue a passion project without the fear of financial repercussions.

Long-Term Advantages of an Emergency Fund

Having an emergency fund offers a multitude of long-term advantages, impacting various aspects of one’s life.

- Reduced Stress and Anxiety: A reliable safety net significantly reduces financial stress and anxiety, allowing for a more peaceful and productive life. This is crucial for mental and emotional well-being.

- Increased Financial Resilience: An emergency fund equips individuals to navigate unexpected financial challenges with greater resilience, demonstrating the ability to weather economic storms.

- Improved Decision-Making: The confidence derived from financial stability leads to improved decision-making, enabling individuals to make choices that align with their long-term goals without the pressure of immediate financial needs.

- Enhanced Opportunity for Growth: Financial security opens doors to various investment and growth opportunities, contributing to a stronger financial foundation and greater financial freedom.

- Greater Freedom and Flexibility: Having an emergency fund provides the freedom to pursue personal and professional opportunities without the fear of financial instability, ultimately increasing flexibility and control over one’s life.

- Improved Self-Confidence: The ability to handle unexpected expenses independently boosts self-confidence and a sense of personal control, fostering a more secure and empowered approach to life.

Practical Strategies and Planning for Building an Emergency Fund

Building an emergency fund is a crucial step towards financial stability. It provides a safety net for unexpected expenses, like medical emergencies, car repairs, or job loss. A well-structured approach to saving can significantly reduce financial stress and foster a sense of security.

Effective emergency fund planning involves a multi-faceted approach that combines disciplined saving strategies with practical budgeting techniques. This section Artikels a step-by-step guide to establishing and maintaining an emergency fund, along with practical methods for saving money and achieving your financial goals.

Step-by-Step Guide to Building an Emergency Fund

Establishing an emergency fund requires a systematic approach. Starting small and consistently adding to the fund is more effective than attempting to amass a large sum quickly. Track your progress and adjust your strategies as needed to stay on track.

- Assess your current financial situation: Determine your income, expenses, and existing savings. Understand your current financial health to establish realistic savings goals. This step allows you to tailor your savings plan to your unique circumstances.

- Set a realistic savings goal: Aim for 3-6 months of living expenses as a target for your emergency fund. This amount will vary based on individual circumstances and expenses. Start with a smaller goal if necessary, and gradually increase it over time.

- Create a budget: Identify your fixed and variable expenses. Categorize your spending and prioritize saving. Track your spending habits to pinpoint areas where you can reduce unnecessary expenses.

- Automate your savings: Set up automatic transfers from your checking account to your savings account each pay period. This removes the mental hurdle of remembering to save and ensures consistent contributions to your emergency fund.

- Regularly review and adjust your plan: Life circumstances change. Periodically review your budget, savings goals, and expenses to ensure your plan remains relevant and effective.

Budgeting Strategies for Allocating Funds

Effective budgeting is essential for allocating funds towards your emergency fund. A well-defined budget allows for conscious spending decisions and ensures that a portion of your income consistently goes towards savings. Consistent budgeting and tracking of expenses are key to long-term financial success.

- Prioritize saving: Treat saving for your emergency fund as a fixed expense. Dedicate a specific amount from each paycheck to your savings, just as you would for rent or utilities. Make saving a non-negotiable part of your financial routine.

- Track your spending: Monitor your spending habits for a month or two to identify areas where you can cut back. Identify patterns in your spending and make conscious decisions to reduce unnecessary expenses.

- Cut unnecessary expenses: Identify and eliminate discretionary spending, such as subscriptions or eating out frequently. Explore cost-effective alternatives to expensive habits to free up more money for savings.

Methods for Saving Money and Achieving Financial Goals

Various methods can be used to save money and achieve your financial goals. Consistency is crucial in achieving long-term financial stability. Explore diverse methods that resonate with your personality and lifestyle.

- Cut back on unnecessary expenses: Examine your spending habits and identify areas where you can reduce costs. Evaluate whether you truly need certain services or purchases, and look for cheaper alternatives if possible.

- Increase your income: Explore options to earn extra money, such as a part-time job, freelance work, or selling unused items. Finding additional income streams can significantly accelerate the process of building your emergency fund.

- Set clear financial goals: Define your financial objectives and break them down into smaller, manageable steps. Having specific targets motivates you and keeps you focused on your progress.

Saving Strategies

A structured approach to saving is vital for achieving your financial goals. A table outlining different strategies, along with their pros, cons, and estimated timelines, can help you choose the best approach.

| Strategy | Pros | Cons | Estimated Timeline |

|---|---|---|---|

| Pay Yourself First | Automated savings, consistent contributions | Requires discipline, might feel restrictive initially | Variable, depends on contribution amount |

| Envelope System | Visual representation of spending | Can be cumbersome for tracking large amounts | Variable, depends on contribution amount |

| High-Yield Savings Account | Higher interest rates | May not be readily accessible | Variable, depends on interest rates |

Importance of Consistent Saving Habits and Discipline

Consistency and discipline are paramount in building an emergency fund. A consistent saving habit is the foundation of financial stability. This disciplined approach fosters financial security and helps you weather unexpected life events.

- Develop a strong saving mindset: View saving as an investment in your future financial well-being. Make saving a priority and treat it as an essential expense, like paying rent or mortgage.

- Establish a realistic savings plan: Consider your financial capacity and create a plan that aligns with your income and expenses. Gradually increase the amount you save over time.

- Stay motivated: Track your progress, celebrate milestones, and visualize the benefits of having an emergency fund.

Ending Remarks: Why Emergency Funds Save More Than Just Money

Why Emergency Funds Save More Than Just Money – In conclusion, the benefits of an emergency fund extend far beyond the immediate monetary value. It fosters a sense of security, promotes financial resilience, and empowers individuals to pursue their goals with confidence. By understanding the psychological advantages, the practical strategies, and the long-term benefits, you can create a financial safety net that protects you from unforeseen circumstances and empowers you to navigate life’s uncertainties with greater peace of mind.

Expert Answers

How much should I save for an emergency fund?

There’s no one-size-fits-all answer. Aim for 3-6 months of living expenses, but adjust based on your specific needs and circumstances. Consider factors like job stability, debt levels, and potential future expenses.

What if I can’t save that much immediately?

Start with what you can afford. Even small, consistent contributions add up over time. Explore different saving strategies to find what works best for your financial situation.

How do I manage unexpected expenses with an emergency fund?

Use the fund strategically for unforeseen events, such as car repairs, medical bills, or job loss. Track your withdrawals and ensure you have a plan for replenishing the fund.

Are there any risks associated with keeping a large emergency fund?

While an emergency fund is crucial, consider the potential risks of keeping large sums in low-yield accounts. Explore options like high-yield savings accounts or CDs to earn interest while maintaining liquidity.