Smart Ways To Make Money In 2025

Introduction to Money-Making Strategies in 2025

Smart Ways to Make Money in 2025 – The economic landscape in 2025 is poised for significant shifts, presenting both challenges and opportunities for individuals seeking to build wealth. Inflationary pressures, though potentially easing, will likely continue to influence spending habits and investment decisions. Technological advancements are rapidly transforming industries, creating new avenues for income generation while simultaneously disrupting traditional employment models. This evolving environment necessitates a nuanced approach to financial planning, demanding adaptability and a willingness to explore innovative money-making strategies. Navigating this complex terrain requires a clear understanding of the key factors shaping financial decisions in the coming year.

| Traditional Methods | Innovative Approaches |

|---|---|

| Stable but Predictable: Traditional avenues like savings accounts, investments in stocks, and real estate offer a degree of security and predictable returns. These methods often rely on established market principles and require careful research and management. | Dynamic and Emerging: Innovative strategies like freelancing, online courses, and the utilization of AI tools offer potential for higher returns but often involve greater risk and require a more proactive approach to learning and adapting. |

While traditional methods remain important, embracing innovation will be crucial for success in the dynamic market of 2025. Understanding the factors driving financial decisions, such as evolving market trends, technological advancements, and shifting consumer preferences, will enable individuals to make informed choices and potentially maximize their financial potential.

Key Factors Influencing Financial Decisions in 2025

Several factors will significantly influence financial decisions in 2025. These include the continued impact of inflation, the rapid advancement of technology, and the evolving needs and expectations of consumers. Understanding these elements is crucial for individuals looking to develop effective strategies for wealth building and income generation.

- Inflationary Pressures: While inflation may show signs of moderation, its lingering effects will influence spending patterns and investment strategies. Consumers will likely prioritize cost-effective solutions, while investors will need to account for the erosion of purchasing power.

- Technological Advancements: The rapid evolution of technology, including artificial intelligence (AI), automation, and the metaverse, will create new industries and job markets. Individuals need to be adaptable and acquire new skills to navigate this evolving landscape effectively.

- Shifting Consumer Preferences: Consumer demands are continuously evolving, often driven by sustainability concerns and a preference for personalized experiences. Businesses and individuals who adapt to these changes will be better positioned to capitalize on emerging opportunities.

Evolving Money-Making Strategies

In the face of these evolving economic forces, a diverse range of money-making strategies will emerge in 2025. This will encompass both traditional methods and innovative approaches, each with its own set of potential advantages and risks.

- Leveraging AI Tools: AI-powered tools can automate tasks, analyze market trends, and personalize financial strategies. By incorporating these tools, individuals can optimize investment decisions and gain insights into emerging opportunities.

- Freelancing and Gig Economy: The gig economy is expected to continue growing, offering flexible work options and the potential for higher earnings. Individuals with specialized skills can leverage these platforms to generate income independently.

- Online Courses and Educational Platforms: The demand for online learning and skill development is expected to rise. Individuals can create and deliver online courses or participate in platforms to enhance their knowledge and skillset, creating income streams from knowledge sharing.

Emerging Online Opportunities

The digital landscape is constantly evolving, presenting new avenues for entrepreneurs and individuals seeking profitable ventures. Online platforms and innovative services are emerging, offering a diverse range of opportunities for those with the right skills and a proactive approach. Understanding these emerging opportunities and adapting to the changing trends is crucial for financial success in 2025 and beyond.

Online Platforms for Profit, Smart Ways to Make Money in 2025

Numerous online platforms are providing robust ecosystems for generating income. These platforms facilitate connections between service providers and clients, enabling the growth of digital businesses. From social media marketing to e-commerce, the options are expanding rapidly. Successfully navigating these platforms requires a strategic approach to marketing and customer engagement. This involves understanding platform algorithms and adapting to changing user behaviors.

Innovative Digital Businesses and Services

Several innovative digital businesses and services are poised for significant growth in 2025. These ventures often leverage emerging technologies like artificial intelligence, blockchain, and virtual reality. Examples include AI-powered customer service chatbots, blockchain-based digital asset management platforms, and virtual reality training simulations for various industries. These businesses offer unique value propositions, catering to evolving customer needs and preferences.

Skills and Knowledge for Success

Success in these emerging fields requires a blend of technical skills and business acumen. A strong understanding of digital marketing, social media management, and data analysis is essential. Furthermore, adaptability and a willingness to learn new technologies are crucial for staying ahead of the curve. Problem-solving skills and the ability to adapt to change are critical in this dynamic environment.

Promising Online Businesses

Understanding the potential of various online ventures is crucial for success. Below is a structured list of five promising online businesses, detailing their key elements and required steps:

- AI-Powered Personalized Learning Platform: This platform utilizes AI algorithms to tailor educational content to individual student needs. Key elements include a robust database of learning materials, sophisticated AI engines for personalized recommendations, and a user-friendly interface. Steps include developing a comprehensive curriculum, integrating AI tools, and building a user base through targeted marketing. This requires expertise in both educational theory and AI programming.

- Virtual Reality Training Simulations: Providing realistic virtual training environments for various industries. Key elements include high-quality 3D modeling, interactive scenarios, and safety protocols. Steps include identifying target industries, developing simulation scenarios, and establishing partnerships with training providers. This demands technical skills in VR development and a deep understanding of industry training needs.

- Blockchain-Based Digital Asset Management: Facilitating secure and transparent management of digital assets. Key elements include a secure blockchain platform, user-friendly interface, and robust security measures. Steps include developing a secure platform, establishing partnerships with financial institutions, and building trust through transparency. Expertise in blockchain technology, cryptography, and financial regulations is essential.

- Social Media Management Agency: Providing tailored social media strategies and management for businesses. Key elements include a comprehensive understanding of social media platforms, proven marketing strategies, and a strong network. Steps include building a portfolio of successful campaigns, establishing partnerships with clients, and providing excellent customer service. Strong social media marketing and communication skills are paramount.

- E-commerce Platform for Sustainable Products: Creating an online marketplace for eco-friendly and sustainable goods. Key elements include a curated selection of sustainable products, environmentally conscious packaging, and transparent supply chains. Steps include sourcing sustainable products, developing a user-friendly website, and building brand awareness through ethical marketing. Knowledge of sustainable practices and consumer preferences for eco-friendly products is essential.

Leveraging Existing Skills and Resources: Smart Ways To Make Money In 2025

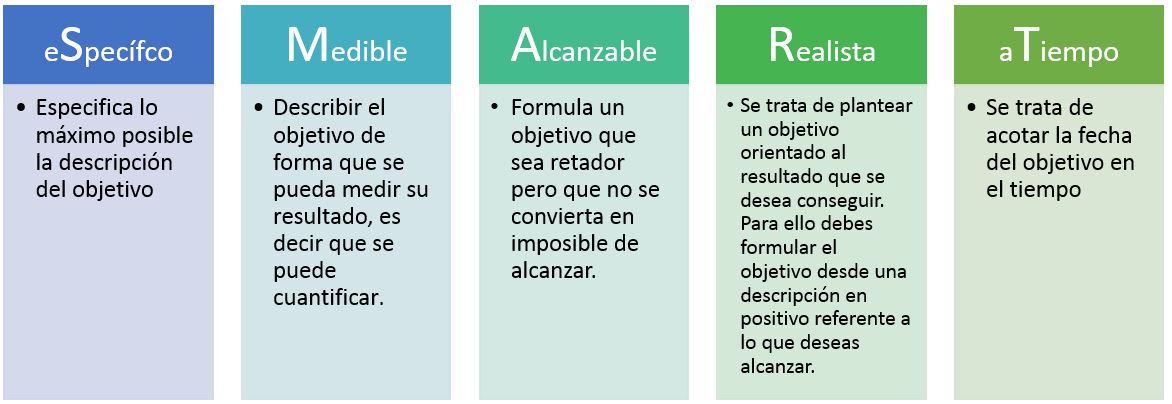

Source: iveconsultores.com

Turning existing skills and resources into income streams is a practical and often overlooked avenue for financial growth in 2025. This approach leverages existing knowledge and experience, reducing the need for extensive upfront investment or specialized training. Individuals can monetize their hobbies, talents, and even unused assets to generate passive or supplementary income.

The key lies in identifying creative applications for existing skills and strategically transforming resources into revenue-generating platforms. Adapting to evolving market demands is crucial for maximizing the potential of these strategies. By upskilling and tailoring offerings to current trends, individuals can maintain a competitive edge and ensure long-term success.

Monetizing Existing Skills

Identifying creative avenues to monetize existing skills is essential. This involves recognizing the transferable value of skills and adapting them to emerging market needs. For instance, a skilled writer can offer ghostwriting services, create online courses, or contribute articles to blogs and publications. The possibilities are diverse, ranging from specialized tutoring to providing expert advice on platforms like online forums or Q&A websites.

Transforming Resources into Income Streams

Transforming existing resources into income streams is a potent strategy. This can involve renting out unused space, like a spare room or parking spot, or selling unused items on online marketplaces. A more sophisticated approach could involve licensing intellectual property or creating and selling digital products related to existing expertise.

Adapting and Upskilling for Evolving Market Demands

Staying ahead of the curve requires continuous adaptation and upskilling. The digital economy is constantly evolving, and individuals need to proactively acquire new skills or refine existing ones to remain competitive. Learning new software, tools, or techniques relevant to the chosen monetization strategy is essential for maintaining relevance. Examples include learning new social media marketing strategies, or mastering data analysis tools. This continuous learning ensures long-term sustainability and adaptability in the dynamic market.

Leveraging Writing Skills: A Practical Example

| Skill | Monetization Strategy | Required Resources |

|---|---|---|

| Writing | Creating and selling online courses on specific writing topics (e.g., technical writing, creative writing, copywriting), providing ghostwriting services, or contributing articles to online publications. | A laptop, reliable internet connection, relevant writing software, and marketing materials. |

Future-Proofing Your Finances

Building long-term financial security requires a proactive approach, adapting to evolving economic landscapes and leveraging opportunities for growth. Strategies for future-proofing your finances go beyond simply saving; they involve understanding risk, diversifying investments, and remaining adaptable to unforeseen circumstances. This approach is crucial in 2025 and beyond, as the financial landscape continues to shift and present new challenges and possibilities.

A robust financial strategy considers not just current market conditions, but also potential future economic shifts. Predicting the future is impossible, but a flexible approach allows you to adjust your plan as needed. Diversification and risk management are essential elements of a future-proofed financial plan.

Diversification Strategies

Diversifying your investment portfolio across various asset classes, including stocks, bonds, real estate, and alternative investments, can help mitigate risk. This approach reduces the impact of any single market downturn. For example, if the stock market experiences a significant decline, a diversified portfolio with a substantial allocation to bonds or real estate can help offset the losses. Maintaining a balanced portfolio that reflects your risk tolerance and long-term financial goals is crucial.

Risk Management Techniques

Implementing effective risk management techniques is vital for long-term financial stability. This involves assessing potential risks and developing strategies to mitigate their impact. Regular reviews of your investment portfolio are necessary to ensure it aligns with your evolving financial goals and risk tolerance. Understanding and managing market volatility is a key component of risk management.

Adapting to Economic Shifts

Economic shifts, both anticipated and unexpected, necessitate the ability to adapt your financial plans. Unforeseen economic downturns, inflation spikes, or technological advancements can impact investment strategies. Developing a contingency plan and regularly evaluating your financial situation is critical to adjusting your approach as needed. Continuously evaluating and adjusting your investment portfolio to match changing economic circumstances is vital.

Investment Strategies for Long-Term Growth

A robust investment strategy is essential for achieving long-term financial goals. Here are three investment strategies that can contribute to long-term growth in 2025 and beyond:

- Index Funds: Index funds track a specific market index, like the S&P 500. This passive investment strategy offers diversification and broad market exposure, minimizing individual stock selection risk. Historically, index funds have demonstrated strong long-term performance.

- Real Estate Investment Trusts (REITs): REITs provide exposure to the real estate market without direct ownership. They can offer diversification and potentially higher returns compared to traditional bonds or savings accounts. Real estate investments can provide consistent income streams and capital appreciation.

- Dividend-Paying Stocks: Companies that pay dividends regularly can provide a steady income stream over time. A well-researched strategy of selecting dividend-paying stocks can contribute to both income generation and capital appreciation.

Wrap-Up

In conclusion, navigating the financial landscape of 2025 requires adaptability and a willingness to explore new opportunities. By understanding emerging trends, leveraging existing skills, and future-proofing your financial strategies, you can position yourself for success. This exploration of smart money-making techniques provides a roadmap for those seeking to thrive in the dynamic economy of the future.

FAQ Summary

What are the best online platforms for starting a business in 2025?

Several platforms facilitate the creation and operation of online businesses. E-commerce platforms like Shopify and Etsy allow you to sell products online. Freelancing platforms like Upwork and Fiverr connect freelancers with clients, providing opportunities for diverse services. Social media platforms also offer avenues for building a brand and selling services or products.

What are some tips for managing risk when investing?

Diversification is key. Don’t put all your eggs in one basket. Explore different investment avenues and consider risk tolerance when creating a financial plan. Thorough research and understanding the market dynamics are crucial for mitigating risk.

How can I leverage my existing skills for income generation?

Identify skills you possess and consider how they can be monetized. Freelancing, creating online courses, or offering consulting services are some examples. Consider developing those skills further to increase their value and income potential.