Why Money Skills Matter More Than Degrees

The Value Proposition of Money Skills

Source: blogspot.com

Mastering practical money management is no longer a luxury, but a necessity in today’s complex financial landscape. The ability to budget, save, invest, and manage debt is increasingly crucial for achieving financial independence and stability, regardless of one’s chosen career path or educational background. This practical skillset can significantly enhance one’s overall well-being and empower them to make informed financial decisions.

The modern world demands more than just theoretical knowledge; it demands practical application. A strong understanding of personal finance allows individuals to navigate economic uncertainties, seize opportunities, and build a secure future. This is especially true in light of unpredictable economic shifts and evolving career landscapes. Money skills are becoming a critical differentiator, often complementing or even exceeding the value of a traditional degree in specific circumstances.

The Significance of Financial Literacy

Financial literacy equips individuals with the tools to make informed decisions about their finances. This leads to reduced stress associated with financial anxieties and empowers individuals to take control of their economic well-being. A sound understanding of personal finance can positively impact overall well-being, allowing for more peace of mind and freedom from financial worries.

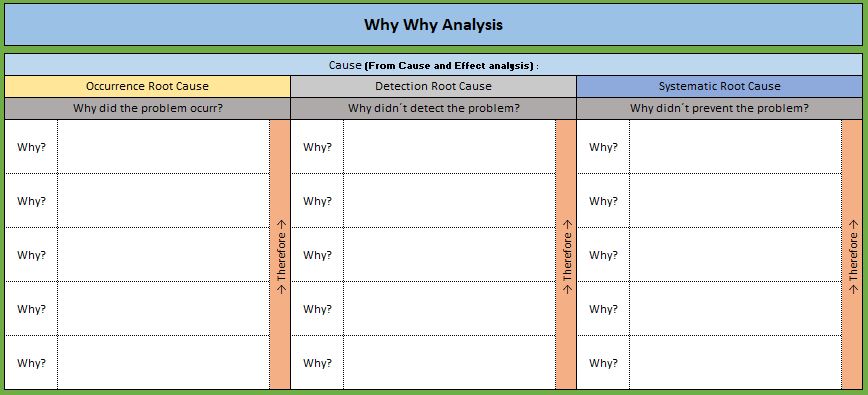

Money Skills vs. Academic Degrees

Strong money skills can often complement or even surpass the value of a specific academic degree in certain career paths and life situations. While specialized knowledge from a degree is invaluable, the ability to manage finances effectively can be just as, or even more, crucial for long-term success.

| Category | Strong Money Skills | Specific Academic Degree (e.g., Engineering) | Further Considerations |

|---|---|---|---|

| Financial Stability | Improved budgeting, saving, and debt management lead to greater financial security and reduced stress. | A degree in engineering can lead to a high earning potential, but without financial literacy, this potential may not translate to long-term stability. | A balance of both skills is ideal. Financial acumen can amplify the benefits of a degree. |

| Career Advancement | Negotiating salaries, understanding investment opportunities, and making informed financial decisions enhance career prospects. | A degree in engineering equips individuals with technical skills, but the ability to manage finances can significantly influence career advancement opportunities. | Financial knowledge can allow an individual to make career choices that align with their long-term financial goals. |

| Personal Well-being | Reduced financial stress leads to improved mental and emotional well-being. | A degree in engineering may offer intellectual stimulation and job satisfaction, but financial literacy can mitigate anxieties about financial security. | Financial independence fosters greater peace of mind and allows individuals to pursue their personal aspirations without the constant pressure of financial worries. |

| Decision-Making | Informed financial decisions lead to better outcomes in personal and professional life. | Engineering knowledge is crucial for technical problem-solving, but financial literacy enables sound decisions about investments and financial resources. | Combining both skills allows individuals to make well-rounded decisions that consider both technical and financial aspects. |

The Limitations of Degrees in a Changing Job Market

Source: knowindustrialengineering.com

Traditional academic paths, while valuable, are increasingly failing to fully equip graduates with the skills needed in today’s dynamic job market. The rapid evolution of industries, driven by technology and globalization, necessitates a different skillset than what many degree programs offer. This gap creates a disconnect between what’s taught in classrooms and what’s required in the modern workplace, making money management skills crucial for navigating the challenges of a constantly changing job landscape.

The modern workplace demands adaptability, problem-solving, and the ability to quickly acquire new skills. While degrees provide foundational knowledge, they often fall short in preparing individuals for the nuanced practical applications required in various sectors. This is particularly true for fields experiencing rapid technological advancement, where theoretical knowledge alone may not be sufficient to secure or advance in a career.

The Disconnect Between Academia and Real-World Needs

The curriculum of many degree programs often focuses on theoretical concepts and broad principles rather than the specific practical skills demanded by employers. For instance, a degree in finance may provide a strong understanding of financial theories, but it might not equip students with the essential budgeting, investing, and financial planning skills needed for success in the real world. This disconnect between academic training and practical application is a significant barrier for many graduates entering the job market.

Practical Skills vs. Academic Knowledge

Traditional educational settings often prioritize academic knowledge over practical skills. This leads to a mismatch between the theoretical frameworks taught and the hands-on applications required in the modern workplace. Students may excel in their coursework but struggle with practical tasks like managing a budget, negotiating salaries, or investing their earnings. Money management skills, often overlooked in degree programs, are essential in navigating these challenges.

Professions Valuing Money Management Skills

Numerous professions, regardless of formal qualifications, highly value strong money management skills. Entrepreneurs, freelancers, consultants, and even entry-level employees in various sectors often rely on these skills to succeed. Effective budgeting, financial planning, and negotiation skills are often crucial for securing contracts, managing resources, and achieving financial goals, irrespective of a specific degree. For example, a skilled freelance graphic designer with excellent money management skills can better manage their income, set realistic pricing, and secure long-term contracts. Likewise, a skilled project manager, regardless of their formal qualifications, can effectively manage budgets and resources with strong financial acumen.

Case Study: The Power of Money Management

A recent case study highlighted the success of a software developer who, despite lacking a formal business degree, built a thriving online business by mastering money management. The developer meticulously tracked their income and expenses, set clear financial goals, and strategically invested their earnings. This approach allowed them to overcome financial challenges, secure crucial funding, and ultimately scale their business, illustrating how strong money skills can compensate for the absence of a specific degree in certain contexts. This exemplifies how money management skills can be a crucial differentiator in navigating career challenges and achieving financial success.

Practical Application of Money Skills

Mastering money skills isn’t just about knowing the basics; it’s about proactively shaping your financial future. These skills empower you to navigate the complexities of personal finance, achieve your financial goals, and build a secure foundation for a fulfilling life. From budgeting and saving to investing and debt management, practical application is key. This section details how to cultivate these skills and leverage them effectively in various aspects of your life.

Developing Strong Money Skills

Cultivating strong money skills is a journey, not a destination. It requires consistent effort, dedication, and a willingness to learn. A crucial first step is creating a personalized budget that accurately reflects your income and expenses. Tracking your spending meticulously helps you identify areas where you can cut back and allocate funds strategically. Beyond budgeting, building an emergency fund is vital. Having a safety net protects you from unexpected expenses and promotes financial stability. Investing wisely is another critical component. Understanding different investment options and strategies allows you to make informed decisions, potentially growing your wealth over time.

Budgeting and Saving

Effective budgeting and saving are fundamental to achieving financial stability. A well-structured budget allocates your income to various categories, such as housing, food, transportation, and entertainment. This allocation allows you to track your spending and identify areas where you can save. Saving, in turn, can be categorized into short-term, medium-term, and long-term goals. For instance, a short-term goal might be saving for a vacation, while a long-term goal could be saving for retirement. Establishing a dedicated savings account and consistently contributing to it, even small amounts, can significantly contribute to your financial goals.

Investing

Investing involves allocating funds to various assets to potentially grow your wealth over time. Common investment options include stocks, bonds, mutual funds, and real estate. It’s crucial to research and understand the risks and potential rewards associated with each investment. Diversification, spreading your investments across different asset classes, can help mitigate risk. Consider consulting a financial advisor to develop a personalized investment strategy tailored to your individual needs and goals.

Managing Debt

Debt management is a critical aspect of personal finance. Understanding different types of debt, such as credit card debt, student loans, and mortgages, is essential. Creating a debt repayment plan can help you prioritize debts and minimize interest payments. Strategies for managing debt include consolidating debts, negotiating interest rates, and utilizing debt management plans. A proactive approach to debt management is crucial to avoid accumulating excessive debt and maintain financial well-being.

Practical Applications of Money Skills

Money skills are applicable across various areas of life. They can help you start and manage a business, effectively manage personal finances, and save for retirement. Starting a business, for example, often requires careful budgeting, financial projections, and understanding cash flow. Similarly, managing personal finances efficiently can significantly reduce stress and promote financial freedom. Proper saving and investment strategies are critical for achieving retirement goals.

Resources for Improving Money Skills

Numerous resources are available to help you enhance your money skills. Books, websites, and online courses provide valuable information and guidance. Some recommended resources include:

- Books: “The Total Money Makeover” by Dave Ramsey, “Rich Dad Poor Dad” by Robert Kiyosaki, “Your Money or Your Life” by Vicki Robin and Joe Dominguez

- Websites: NerdWallet, Investopedia, The Motley Fool

- Courses: Coursera, edX, Udemy offer various personal finance courses.

Managing Your First Paycheck (New Graduate Guide), Why Money Skills Matter More Than Degrees

| Category | Description | Example | Action Steps |

|---|---|---|---|

| Budgeting | Allocate income to different expenses. | Housing (rent/mortgage), food, transportation, entertainment. | Create a spreadsheet or use budgeting apps. Track spending for a month. |

| Saving | Set aside a portion of income for future goals. | Emergency fund, short-term goals (vacation), long-term goals (retirement). | Open a savings account. Automate transfers to savings. |

| Debt Management | Prioritize and manage outstanding debts. | Student loans, credit card debt. | Create a debt repayment plan. Consider debt consolidation. |

| Investing | Start investing early to benefit from compounding. | Low-cost index funds, ETFs. | Research investment options. Consider a robo-advisor. |

Cultivating a Mindset for Financial Success

Developing a robust financial mindset is crucial for achieving long-term financial well-being. It’s not just about the numbers; it’s about cultivating a proactive and responsible attitude towards money management. This involves understanding your financial motivations, overcoming anxieties, and maintaining discipline throughout your journey. A strong financial mindset empowers you to make sound decisions, even when faced with challenges, ultimately leading to greater financial freedom and reduced stress.

Proactive and Responsible Financial Attitudes

A proactive and responsible attitude towards finances involves taking control of your financial situation rather than being reactive. This includes budgeting, saving, and investing. A proactive approach allows you to anticipate future needs and adjust your strategies accordingly. It’s about understanding your financial goals and creating a roadmap to achieve them. Responsibility entails acknowledging your financial obligations and consistently working towards meeting them.

| Actionable Step | Description | Example | Impact |

|---|---|---|---|

| Create a detailed budget. | Track income and expenses to understand where your money goes. | Categorize spending (housing, food, entertainment) and identify areas for potential savings. | Provides clarity on spending habits and opportunities for cost reduction. |

| Develop a savings plan. | Set realistic savings goals and establish a systematic savings strategy. | Aim for a specific amount each month and use automatic transfers to savings accounts. | Builds a financial safety net and prepares for future goals. |

| Establish clear financial goals. | Define short-term and long-term financial objectives. | Examples: Emergency fund, down payment for a house, retirement savings. | Provides direction and motivation for financial decisions. |

| Seek professional financial advice. | Consult a financial advisor for personalized guidance and strategies. | An advisor can help with investment strategies, debt management, and retirement planning. | Enhances financial knowledge and improves decision-making. |

Psychological Aspects of Financial Well-being

Financial well-being is significantly influenced by psychological factors. Financial anxieties, such as fear of loss or scarcity, can hinder progress. Understanding these anxieties is crucial for overcoming them. Developing positive financial habits, such as consistent saving and smart spending, can significantly reduce these anxieties.

| Actionable Step | Description | Example | Impact |

|---|---|---|---|

| Identify and challenge negative financial beliefs. | Recognize and reframe limiting beliefs about money. | Replace “I’m not good with money” with “I can learn and improve my money management skills.” | Reduces self-doubt and promotes a positive mindset. |

| Practice mindfulness and stress management techniques. | Develop coping mechanisms for financial stress. | Meditation, deep breathing, or spending time in nature. | Reduces stress and promotes emotional well-being. |

| Seek support from trusted individuals. | Connect with family, friends, or financial advisors for guidance. | Talking to a supportive friend or joining a financial group. | Provides a sense of community and accountability. |

| Celebrate small victories. | Acknowledge and reward progress in financial goals. | Reward yourself for meeting savings targets. | Encourages motivation and fosters a positive feedback loop. |

Strategies for Maintaining Motivation and Discipline

Maintaining motivation and discipline is essential for long-term financial success. Setting realistic goals, tracking progress, and celebrating milestones are effective strategies. Seeking support from trusted individuals can provide encouragement and accountability.

| Actionable Step | Description | Example | Impact |

|---|---|---|---|

| Establish a clear financial plan. | Create a roadmap for achieving financial goals. | Artikel specific steps and timelines for each goal. | Provides direction and structure for achieving long-term objectives. |

| Track your progress regularly. | Monitor your financial progress and adjust strategies as needed. | Use spreadsheets or budgeting apps to track income, expenses, and savings. | Helps identify areas for improvement and maintain motivation. |

| Seek support from mentors or peers. | Connect with individuals who share similar financial goals. | Join a financial support group or seek advice from a mentor. | Provides encouragement, accountability, and diverse perspectives. |

| Reward yourself for milestones. | Celebrate achievements to reinforce positive behaviors. | Reward yourself for reaching a savings target or paying off debt. | Reinforces positive behaviors and maintains motivation. |

Building a Strong Financial Mindset for Long-Term Success

Developing a strong financial mindset is not a one-time event but a continuous process. By implementing these strategies, you can build resilience and maintain a positive outlook. This will lead to long-term financial success and reduce financial stress. It is crucial to understand that financial well-being is not just about accumulating wealth, but also about managing resources effectively and achieving financial peace of mind.

Ending Remarks: Why Money Skills Matter More Than Degrees

Why Money Skills Matter More Than Degrees – In conclusion, while academic degrees remain valuable, the rising importance of money skills cannot be overstated. Developing strong financial literacy is key to navigating today’s complex economic landscape and achieving long-term financial success. This comprehensive guide equips readers with the knowledge and tools necessary to cultivate a proactive and responsible approach to personal finance, leading to improved well-being and financial security.

FAQ Explained

How can I improve my money skills?

Improving money skills involves a multifaceted approach. Budgeting, saving, and investing are key components. Resources like books, websites, and courses can provide valuable guidance. Seeking professional financial advice is also a worthwhile option.

What are some examples of professions where strong money management skills are valued?

Strong money management skills are valuable in many professions, not just finance-related ones. Entrepreneurs, freelancers, and even those in technical fields benefit from strong financial acumen. This includes project management, strategic planning, and risk assessment.

How do I manage my first paycheck effectively?

Managing your first paycheck effectively involves careful budgeting. Prioritize essential expenses, create a savings plan, and consider debt management strategies.

Why is a proactive attitude towards finances important?

A proactive attitude towards finances fosters financial well-being. It involves responsible spending, proactive saving, and seeking knowledge to make informed financial decisions.