Why Most Americans Struggle With Money Management

Understanding the Financial Landscape of American Households

Source: blogspot.com

The financial health of American households varies significantly based on numerous factors, including age, location, family size, and income. Understanding these nuances is crucial for developing effective strategies to address money management challenges and achieve financial well-being. A comprehensive overview of these factors allows for tailored approaches to financial planning and advice.

The American financial landscape is a complex tapestry woven from diverse threads of income, expenses, and financial priorities. Examining the typical patterns and variations across different demographics provides insights into the challenges and opportunities faced by various groups. This understanding helps to identify specific needs and tailor financial guidance to individual circumstances.

Common American Household Income Levels and Expenses

American household incomes exhibit a wide range. Lower-income households often face significant financial pressures, while higher-income households may have greater flexibility in their spending and saving habits. The geographical location of a household can also greatly impact its income and cost of living.

- Lower-income households (under $50,000 annually): Often characterized by a high proportion of income allocated to necessities like housing and food. Saving for emergencies and long-term goals might be a lower priority. For example, a single parent with two children in a low-cost area may find that a substantial portion of their income is dedicated to housing and childcare costs.

- Middle-income households ($50,000-$150,000 annually): These households typically have a better ability to save and plan for the future. The portion of income dedicated to housing, food, and transportation is still significant, but they may have more disposable income for entertainment, education, or other expenses. A family of four living in a moderate-cost area with two working adults may have more opportunities to save for college funds or a down payment on a house.

- Higher-income households (over $150,000 annually): These households often have more options in terms of financial choices. They may allocate a greater percentage of their income to savings, investments, or luxury items. A dual-income couple in a high-cost metropolitan area may allocate a substantial portion of their income to housing costs but still have flexibility to save for retirement and make significant investments.

Financial Priorities and Goals Among Various Demographics

Different demographic groups prioritize different financial goals. Age, family structure, and career stage significantly influence these priorities.

- Young adults (18-35): Often prioritize building credit, establishing an emergency fund, and saving for a down payment on a home. Many in this demographic may have student loan debt and be focused on career advancement, affecting their ability to save and invest. For example, a young professional with student loan payments may prioritize building an emergency fund and paying off debt over long-term investments.

- Middle-aged adults (36-55): Often focus on saving for retirement, funding children’s education, and potentially buying a larger or more expensive home. The need for financial security increases as they approach retirement and may involve significant investment decisions. For instance, a family with school-aged children may focus on funding their children’s education and establishing a solid retirement savings plan.

- Older adults (55+): Their financial priorities shift towards securing their retirement, managing healthcare expenses, and potentially leaving an inheritance. This demographic may need to understand and adapt to changes in their healthcare needs, which may affect their budgeting. For example, a retired couple may need to adjust their budget to accommodate increasing healthcare costs.

Typical Saving and Spending Habits Across Different Income Brackets

Saving and spending habits vary significantly across different income levels.

- Lower-income households: Often prioritize essential expenses and have limited capacity to save. Building an emergency fund may be a challenge, leading to reliance on debt when unexpected expenses arise. For example, a single parent with a lower-income job might struggle to save for retirement or a down payment on a house, and might rely on credit cards for emergencies.

- Middle-income households: May have a moderate capacity to save, often allocating a portion of income to savings, retirement accounts, and other financial goals. Their spending habits may be more varied, balancing needs with wants. For example, a family with two working parents may allocate a portion of their income to savings, retirement funds, and children’s education.

- Higher-income households: Generally have a higher capacity to save and invest, often seeking higher returns and diversifying their investments. Their spending habits may include luxury goods, travel, and philanthropic giving. For example, a wealthy couple might invest in a variety of assets, including stocks, bonds, and real estate, and donate to charitable causes.

Average Monthly Budget Allocations in the US

This table provides an overview of average monthly budget allocations across different income levels in the US.

| Income Level | Housing | Food | Transportation | Healthcare | Entertainment |

|---|---|---|---|---|---|

| Lower-Income (<$50,000) | 30% | 25% | 15% | 5% | 5% |

| Middle-Income ($50,000-$150,000) | 25% | 20% | 15% | 8% | 10% |

| Higher-Income (>$150,000) | 20% | 15% | 10% | 10% | 15% |

Identifying Barriers to Effective Money Management

Americans face a complex web of challenges when it comes to managing their finances. Beyond simple budgeting, numerous psychological, societal, and economic factors contribute to difficulties in achieving financial well-being. Understanding these barriers is crucial for developing targeted solutions and fostering healthier financial habits.

Common misconceptions about money often impede progress. For instance, the belief that wealth accumulation solely depends on high-income jobs or risky investments overlooks the power of consistent savings and smart spending habits. Similarly, the perception that financial success is solely a matter of individual willpower can overlook systemic issues and the impact of societal pressures.

Common Misconceptions and Psychological Factors

Many Americans harbor misconceptions about money, leading to poor financial choices. The idea that wealth is solely dependent on high-income jobs or luck often leads to inaction and a lack of proactive financial planning. Furthermore, some individuals struggle with a lack of financial literacy, leading to a misunderstanding of investment options, compound interest, and other critical financial concepts. Psychological factors like fear of loss, impulsivity, and a lack of delayed gratification can also significantly hinder financial progress.

Role of Debt in Hindering Financial Well-being

High levels of debt, particularly credit card debt and student loans, severely constrain Americans’ financial capabilities. The interest accrued on these debts can quickly snowball, making it difficult to save and invest for the future. Debt often leads to financial stress and anxiety, which can impact overall well-being. For instance, the high cost of student loans frequently forces recent graduates to postpone significant life events like buying a home or starting a family.

Impact of Financial Literacy Levels, Why Most Americans Struggle With Money Management

Financial literacy plays a critical role in Americans’ ability to manage their money effectively. A lack of understanding of basic financial concepts, such as budgeting, saving, investing, and debt management, can lead to poor financial choices and accumulate debt over time. Individuals with lower financial literacy often struggle to understand and navigate complex financial products, making them vulnerable to predatory lending practices. This lack of knowledge can perpetuate a cycle of financial instability.

Prevalence of Financial Stress, Anxiety, and Procrastination

Financial stress, anxiety, and procrastination are prevalent across various demographics, although their manifestation and intensity may vary. For instance, younger generations, facing high student loan burdens and the pressure of immediate needs, often experience significant financial stress. Conversely, middle-aged Americans may grapple with the pressures of retirement planning and managing family obligations. In general, individuals experiencing financial stress often find it challenging to make rational decisions and prioritize long-term financial goals. Procrastination regarding financial matters often leads to the accumulation of debt and an inability to save for future needs.

Common Money Management Pitfalls

- Impulse Purchases: The tendency to make unplanned purchases, often driven by immediate gratification, can significantly deplete savings and hinder long-term financial goals. This frequently occurs due to societal pressures, marketing tactics, and a lack of financial discipline. For example, purchasing non-essential items during promotional periods, while seemingly harmless, can accumulate quickly, resulting in a substantial loss of funds over time.

- Lack of Budgeting: A significant barrier to effective money management is the lack of a well-defined budget. Without a structured plan for income and expenses, individuals often find themselves struggling to track their spending and make informed financial decisions. The inability to allocate funds towards savings or investments can hinder long-term financial success.

- Poor Investment Choices: Making uninformed or impulsive investment decisions can lead to substantial financial losses. A lack of understanding of investment principles and a failure to diversify investments can expose individuals to significant risks. For example, investing in a single high-risk stock can lead to significant losses if the stock performs poorly.

Examining Educational Gaps and Access to Resources

Financial literacy is crucial for navigating the complexities of the American financial landscape. However, significant disparities exist in access to quality financial education and resources, impacting individuals’ ability to manage their finances effectively. Understanding these gaps is essential for developing targeted interventions and promoting financial well-being across demographics.

Financial Education Programs

A wide array of financial education programs are available to Americans, encompassing both formal and informal methods. These programs aim to equip individuals with the knowledge and skills needed to make informed financial decisions. Formal programs often take place in schools, community centers, or workplaces, while informal methods include personal finance books, online resources, and personal interactions.

Comparison of Financial Education Methods

Different financial education methods have varying degrees of effectiveness. The effectiveness often depends on the individual’s learning style, available time, and desired level of engagement.

| Method | Effectiveness Factors | Advantages | Disadvantages |

|---|---|---|---|

| Online Courses | Convenience, accessibility, interactive learning, potentially lower cost | Flexible scheduling, self-paced learning, diverse content, often affordable | Requires self-discipline, limited personal interaction, may not address specific needs |

| Workshops | Structured learning, interactive exercises, direct feedback from instructors | Hands-on experience, practical application, opportunity for Q&A, instructor support | Limited flexibility, often time-consuming, may not suit all learning styles |

| Personal Finance Books | Self-directed learning, affordable, accessible anytime | Convenient, potentially low cost, suitable for self-learners | Limited interactive elements, may not be tailored to specific needs, less personalized guidance |

| Financial Advisors | Personalized guidance, tailored financial strategies, access to diverse resources | Expertise in financial planning, investment strategies, risk management, long-term goals | Costly, potentially time-consuming, may not be suitable for all income brackets |

Accessibility of Resources and Support Services

Access to financial resources and support services varies significantly across different demographics. Factors such as income level, geographic location, and educational background can influence access to crucial programs like credit counseling and debt management. Low-income individuals and communities often face greater barriers to accessing these services due to cost, lack of awareness, or limited transportation.

Role of Financial Advisors

Financial advisors play a crucial role in guiding individuals toward sound financial practices. However, their availability and affordability can differ based on income levels. High-income individuals often have greater access to a wider range of financial advisors and sophisticated financial planning services. Those with lower incomes may struggle to afford professional guidance or may not even know where to find affordable options.

Government Policies and Initiatives

Government policies and initiatives play a significant role in shaping financial literacy and money management in the United States. Programs focused on financial education in schools, consumer protection initiatives, and tax policies can significantly impact individual financial well-being. Examples include the expansion of financial education curricula in schools and the implementation of government-backed financial literacy campaigns. These efforts can positively impact the financial stability of the American population.

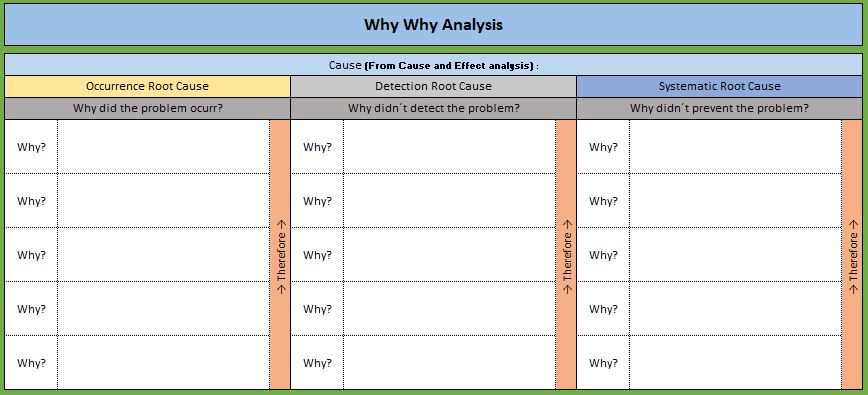

Suggesting Strategies for Improvement: Why Most Americans Struggle With Money Management

Source: knowindustrialengineering.com

Improving personal financial management is a multifaceted process requiring a structured approach and adaptable strategies. Understanding individual financial situations and tailoring solutions is crucial for sustainable success. This section details actionable steps for diverse demographics, encompassing budgeting, emergency funds, debt management, saving, investing, and financial literacy.

Effective financial management is not merely about accumulating wealth, but also about developing responsible habits and building financial security. This section offers a practical guide to building a solid financial foundation and achieving long-term financial goals.

Creating and Sticking to a Budget

A budget is a roadmap for managing income and expenses. It helps track spending patterns and identify areas for potential savings. Creating a realistic budget is essential for achieving financial stability. A well-structured budget considers all sources of income and allocates funds to various categories like housing, food, transportation, entertainment, and debt repayment.

- Track Income and Expenses: Use budgeting apps, spreadsheets, or notebooks to meticulously record all income sources and expenses. Categorize expenses to identify areas where spending might be excessive.

- Set Realistic Goals: Define short-term and long-term financial goals. A clear vision of what you want to achieve will motivate you to stick to the budget.

- Prioritize Essential Expenses: Allocate funds to essential expenses like housing, food, and utilities before allocating money to discretionary items.

- Review and Adjust: Regularly review your budget to assess its effectiveness. Adjust it as needed to reflect changing circumstances or priorities.

Building an Emergency Fund

An emergency fund acts as a safety net for unexpected expenses. Having enough savings for emergencies reduces the likelihood of incurring debt during difficult times. A general rule of thumb is to aim for 3-6 months of living expenses in an emergency fund.

- Determine Needs: Assess your monthly living expenses to determine the appropriate amount for an emergency fund.

- Automate Savings: Set up automatic transfers from your checking account to a dedicated savings account to build the emergency fund gradually.

- Regular Contributions: Make consistent contributions to your emergency fund, even if it’s a small amount each pay period.

Managing Debt Effectively

Effective debt management is crucial for achieving financial freedom. High-interest debt should be prioritized for repayment to minimize the overall cost of borrowing. Understanding different debt repayment strategies is key to achieving financial goals.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first to save money on interest charges.

- Debt Consolidation: Consider consolidating multiple debts into a single loan with a lower interest rate, if possible.

- Create a Repayment Plan: Develop a structured plan to repay debts over time, considering your income and expenses.

Saving for Long-Term Goals

Saving for long-term goals like retirement and homeownership requires a disciplined approach and consistent contributions. Early planning and consistent saving are essential for achieving long-term financial security.

- Retirement Planning: Contribute to retirement accounts like 401(k)s or IRAs to build a nest egg for your future.

- Homeownership: Create a savings plan for a down payment on a home, considering factors like interest rates and mortgage costs.

- Other Goals: Establish specific savings goals for other long-term aspirations, such as education or travel.

Investing and Investment Options

Investing can significantly increase your wealth over time. Understanding different investment options and diversifying your portfolio are important steps to building wealth.

- Diversification: Spread your investments across different asset classes to mitigate risk.

- Stock Market: Explore the stock market, understanding its potential for growth, and research different investment strategies.

- Bonds: Consider bonds for a more stable form of investment, often used in diversified portfolios.

- Mutual Funds: Consider mutual funds, which allow for diversified investment in various stocks or bonds.

Improving Financial Literacy

Improving financial literacy is crucial for making informed financial decisions. Accessing accessible resources can greatly improve understanding and skill development.

- Seek Financial Advice: Consult with a qualified financial advisor to receive personalized guidance.

- Educational Resources: Utilize online resources, books, and workshops to enhance financial knowledge.

- Financial Education Courses: Enroll in financial literacy courses or workshops to gain practical skills and knowledge.

Managing Daily Spending and Avoiding Unnecessary Expenses

Managing daily spending is essential for controlling overall expenses. Conscious spending choices and avoidance of unnecessary expenses can significantly impact savings.

- Track Spending: Regularly monitor daily spending to identify patterns and areas for potential savings.

- Budget for Discretionary Spending: Set aside a specific amount for entertainment and non-essential purchases.

- Avoid Impulse Purchases: Consider purchases carefully and avoid impulsive spending to save money.

Final Review

Why Most Americans Struggle With Money Management – In conclusion, the financial struggles faced by many Americans are multifaceted, stemming from a complex interplay of economic realities, psychological factors, and educational gaps. While the challenges are significant, the article underscores the availability of resources and actionable strategies for achieving better financial well-being. By understanding these interconnected elements, Americans can develop a personalized approach to money management and work towards achieving their financial goals.

Common Queries

What are some common misconceptions about money management that hinder Americans?

Many Americans hold misconceptions about their ability to save, invest, and manage debt. Some believe that financial success is solely dependent on high income, while others lack understanding of compound interest and long-term financial planning. Furthermore, some individuals fail to create a realistic budget, prioritize needs over wants, and underestimate the power of compounding.

How does debt impact Americans’ financial well-being?

High levels of debt, including credit card debt and student loans, can severely restrict financial freedom and limit opportunities for saving and investing. Debt can lead to financial stress, anxiety, and difficulty achieving long-term financial goals. This often results in a vicious cycle of debt accumulation and decreased financial well-being.

What specific financial resources and support services are available to Americans?

Americans can access a variety of financial resources, including credit counseling services, debt management programs, and online financial education platforms. Non-profit organizations and government agencies often offer free or low-cost resources to help individuals manage debt and improve their financial literacy.

What are some practical tips for managing daily spending and avoiding unnecessary expenses?

Tracking expenses, creating a detailed budget, prioritizing needs over wants, and setting realistic financial goals are practical steps toward managing daily spending and avoiding unnecessary expenses. Using budgeting apps, automating savings, and reviewing spending patterns can help.