Why Saving Money Feels Harder Than Ever

The Inflationary Impact on Savings: Why Saving Money Feels Harder Than Ever

Saving money feels increasingly challenging in today’s economic climate, largely due to the persistent effects of inflation. Inflation erodes the purchasing power of your savings, meaning the same amount of money buys less over time. This subtle but significant decrease in value necessitates a keen understanding of how inflation impacts different savings strategies.

Inflation reduces the real return on savings, effectively lowering the amount of goods and services your savings can purchase. This impact varies based on the type of savings account or investment chosen. Understanding this dynamic is critical for making informed financial decisions and maintaining a healthy financial future.

Impact of Inflation on Purchasing Power

Inflation directly reduces the purchasing power of savings. A fixed amount of money in a savings account will buy fewer goods and services in the future compared to the present, as prices rise. This diminishing value is a fundamental economic principle impacting all savings strategies. For example, if inflation averages 3% annually, a $1000 deposit will effectively buy only $970 worth of goods and services a year later.

Inflation and Different Savings Strategies

Different savings strategies respond differently to inflation. Fixed-rate savings accounts, often offering a guaranteed interest rate, struggle to keep pace with rising prices. While providing a degree of certainty, they often fail to maintain the real value of the principal due to inflation outpacing the interest rate. High-yield savings accounts, while often more dynamic in their interest rates, might not always overcome the inflation hurdle, especially if the interest rate doesn’t keep pace with inflation. Bonds, particularly those with fixed interest rates, face similar challenges. The real return, considering the inflation rate, can become significantly reduced.

Table Illustrating Diminishing Value

The table below demonstrates how a fixed amount of savings diminishes in real value over time due to varying inflation rates. It clearly shows the crucial role inflation plays in the actual return on savings.

| Inflation Rate (%) | Savings Amount (Year 0) | Savings Value (Year 5) | Savings Value (Year 10) | Savings Value (Year 20) |

|---|---|---|---|---|

| 2 | $10,000 | $11,040.81 | $12,166.53 | $14,859.47 |

| 3 | $10,000 | $10,471.28 | $11,058.61 | $13,439.16 |

| 4 | $10,000 | $9,880.00 | $9,418.81 | $8,100.19 |

| 5 | $10,000 | $9,302.34 | $8,655.59 | $6,835.00 |

The Cost of Living Crisis and its Effect on Budgets

The escalating cost of living is significantly impacting household budgets across the globe. Rising prices for essential goods and services are making it increasingly difficult for individuals and families to maintain their standard of living and save money. This pressure on finances often leads to a trade-off between essential needs and long-term financial goals.

The increasing costs of housing, transportation, and food are disproportionately affecting lower-income households, widening the gap between the wealthy and the less fortunate. Many individuals are struggling to keep up with the escalating expenses, leading to financial stress and a diminished capacity to save. Strategies for coping with these rising costs are becoming increasingly important.

Rising Costs of Essential Goods and Services, Why Saving Money Feels Harder Than Ever

The price increases for essential goods and services have been a notable feature of the current economic climate. Housing costs, including rent and mortgage payments, have seen significant upward trends in recent years. Transportation expenses, encompassing fuel prices and public transportation fares, have also experienced considerable increases. Food prices, particularly for staples like fruits, vegetables, and protein sources, have risen substantially. These factors have combined to exert substantial pressure on household budgets.

Impact on Household Budgets and Savings

The rising costs of essential goods and services directly impact household budgets and the ability to save. As expenses increase, the disposable income available for savings decreases. This effect is compounded when wage increases fail to keep pace with price increases. Families are often forced to prioritize essential needs over savings goals. For example, a household might have to reduce spending on entertainment or leisure activities to maintain essential services.

Strategies for Coping with Rising Expenses

Individuals and families are employing a range of strategies to cope with the rising cost of living. Budgeting apps and tools are gaining popularity as people attempt to track and manage their spending. Meal prepping is becoming a common practice, allowing households to control food costs by preparing meals in advance. Seeking ways to reduce energy consumption, such as improving home insulation or using energy-efficient appliances, is another common response.

Average Price Increases for Essential Items (Past 3 Years)

| Category | Average Price Increase (%) |

|---|---|

| Housing (Rent/Mortgage) | 8-12% |

| Transportation (Fuel) | 15-20% |

| Food (Groceries) | 7-10% |

| Utilities | 5-7% |

Why Saving Money Feels Harder Than Ever – Note: These are estimated averages and actual figures may vary based on location and specific items.

Illustrating the Gap Between Income and Expenditure

To illustrate the gap between income and expenditure, consider a hypothetical example. A family with a fixed income of $4000 per month faces rising costs for rent ($1500), transportation ($300), and food ($800). This results in an expenditure of $2600, leaving a significant shortfall in savings. Visualizing this difference through a simple bar chart or a pie chart would clearly show the gap between available income and the total expenditure.

A simple illustration of the difference between income and expenditure is crucial in understanding the financial implications of the cost-of-living crisis.

The Psychology of Saving and the Challenges of Delaying Gratification

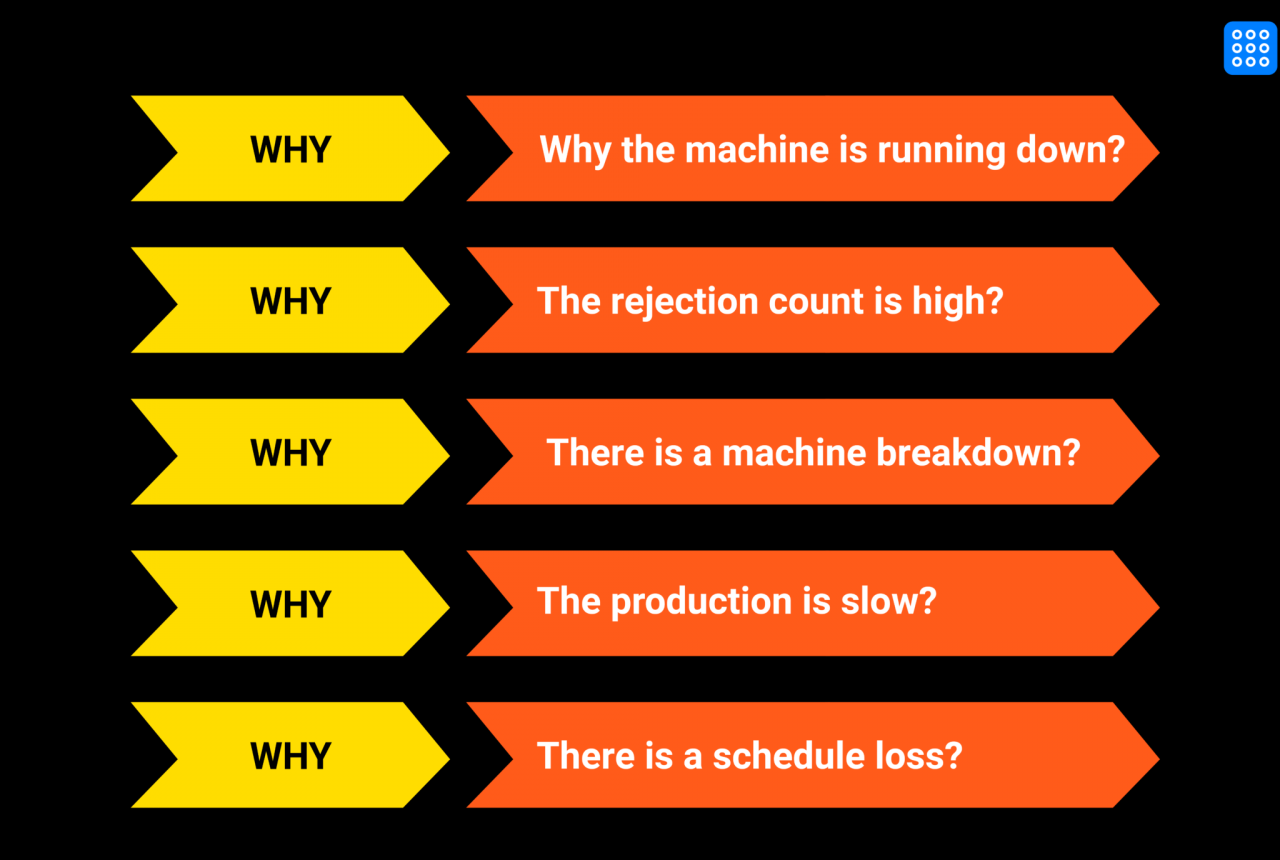

Source: fogwing.io

Saving money often feels like a constant battle, even when the economic conditions are favorable. This isn’t just about the practical aspects of budgeting and inflation; it’s deeply rooted in our psychology. Understanding the psychological factors that make saving difficult is crucial for developing effective strategies.

The human brain is wired to prioritize immediate rewards over future benefits. This inherent tendency towards instant gratification often clashes with the long-term goals of saving. We’re wired to seek pleasure and avoid pain, and the immediate pleasure of spending feels more tangible and satisfying than the potential future benefit of saving.

The Role of Instant Gratification

Our desire for immediate gratification is a powerful motivator. The pleasure of buying something now, experiencing a fun activity, or indulging in a treat is immediate and tangible. The potential reward of saving, on the other hand, is often delayed and less concrete. This difference in perceived value contributes significantly to the challenge of saving.

Emotional and Behavioral Patterns Hindering Savings

Several emotional and behavioral patterns can prevent individuals from saving. Fear of missing out (FOMO), anxiety about the future, and a lack of financial literacy can all contribute to impulsive spending habits. Also, a history of financial hardship or a feeling of scarcity can lead to a mindset that prioritizes immediate needs over long-term financial security. Furthermore, a lack of clear financial goals or the perception of saving as a chore can demotivate individuals.

Illustrative Examples of Delayed Gratification Challenges

Imagine a young professional who earns a significant bonus. The temptation to treat themselves to a luxurious vacation, a new car, or expensive items is strong. However, the long-term benefits of investing that money or saving it for a down payment on a house might not be as immediately apparent. This scenario highlights the conflict between immediate gratification and long-term financial security.

Strategies for Overcoming Psychological Barriers

Developing effective strategies to overcome psychological barriers is crucial. Creating a savings plan and setting realistic goals is a key step. The plan should include clearly defined savings targets and timelines, making the long-term benefits more tangible. Utilizing automated savings mechanisms, such as setting up direct transfers to a savings account, can help build saving habits. Furthermore, associating savings with positive reinforcement can motivate individuals to maintain their financial goals. This can be achieved through rewards for reaching milestones or creating a sense of accomplishment.

The Analogy of the Marshmallow Test

A classic experiment, the marshmallow test, illustrates the concept of delayed gratification. Children were presented with a choice: eat one marshmallow immediately or wait 15 minutes and receive two marshmallows. The results revealed that children who could delay gratification often achieved better academic and life outcomes later in life. This highlights the long-term benefits of delaying immediate gratification.

Alternative Saving Strategies and Financial Planning

Beyond traditional savings accounts, diversifying your investment portfolio and implementing a robust financial plan are crucial for achieving long-term financial security. These strategies allow you to navigate the current economic climate and optimize your returns. Understanding different investment vehicles, their associated risks, and the significance of financial planning empowers you to make informed decisions and build a strong financial foundation.

Exploring Alternative Saving Strategies

A diversified approach to savings involves more than just traditional methods like high-yield savings accounts. Exploring alternative investment vehicles can potentially enhance your returns, though it’s essential to carefully consider the risks involved. These options, when integrated into a well-structured financial plan, can significantly impact your long-term financial well-being.

- Stocks: Stocks represent ownership in a company. They offer the potential for high returns but also carry significant risk. The value of stocks fluctuates based on market conditions and company performance. For instance, the tech boom of the late 1990s saw considerable stock appreciation, but the dot-com bust demonstrated the inherent volatility.

- Bonds: Bonds are essentially loans to a government or corporation. They generally offer lower returns compared to stocks but are considered less risky. Government bonds, for example, are often seen as a safe haven during economic uncertainty.

- Real Estate: Real estate investment, such as owning rental properties, can provide substantial returns. However, it requires significant upfront capital and ongoing management. Real estate investments can be a long-term wealth-building strategy, but it’s essential to consider associated costs like property taxes and maintenance.

- Mutual Funds and Exchange-Traded Funds (ETFs): These pooled investment vehicles allow you to diversify your holdings across various asset classes. Mutual funds are managed by professional fund managers, while ETFs trade like individual stocks. They can offer a balanced approach to risk and return, depending on the specific fund.

Comparing Investment Vehicles

Understanding the risk-return profile of different investment vehicles is critical. A well-balanced portfolio should consider your risk tolerance and financial goals. High-risk investments may yield greater returns but could also lead to substantial losses during market downturns.

| Asset Class | Potential Return (5-Year Average Estimate) | Risk Level |

|---|---|---|

| High-Yield Savings Account | 1-3% | Low |

| Stocks (e.g., S&P 500) | 7-12% | Medium to High |

| Bonds (e.g., US Treasury Bonds) | 3-5% | Low |

| Real Estate (e.g., rental properties) | 5-8% | Medium to High |

| Mutual Funds/ETFs (Balanced) | 5-10% | Medium |

Note: Potential returns are estimates and may vary significantly. Past performance is not indicative of future results.

The Importance of Financial Planning

A comprehensive financial plan acts as a roadmap for your financial future. It helps you align your short-term and long-term goals with your financial resources. It’s a dynamic document that needs periodic review and adjustments.

- Budgeting: A detailed budget Artikels your income and expenses, enabling you to track spending and identify areas for potential savings. It’s an essential component of effective financial management.

- Goal Setting: Defining clear short-term and long-term financial objectives (e.g., buying a house, funding retirement) helps prioritize savings and investments. This could involve saving for a down payment on a house, paying off debt, or building an emergency fund.

- Risk Assessment: Evaluating your personal risk tolerance is vital. Different investments have varying degrees of risk. Understanding your comfort level with potential losses helps you allocate assets appropriately.

Simplified Financial Planning Approach

Creating a simplified financial plan involves these key steps:

- Assess your current financial situation: Determine your income, expenses, assets, and debts.

- Define your short-term and long-term goals: List specific financial objectives, such as saving for a down payment or retirement.

- Develop a budget: Track your income and expenses to identify areas where you can save and allocate funds towards your goals.

- Choose appropriate investment vehicles: Select investments aligned with your risk tolerance and financial goals. Diversification is key to mitigating risk.

- Review and adjust your plan regularly: Life circumstances change, so it’s important to revisit and modify your financial plan as needed.

Last Recap

Source: blogspot.com

In conclusion, saving money feels harder than ever due to a complex interplay of economic pressures and human psychology. Inflation’s relentless impact on purchasing power, coupled with the escalating cost of living, significantly reduces the real return on savings. The psychological tendency toward immediate gratification further complicates matters. While the challenges are undeniable, alternative strategies and sound financial planning can empower individuals to achieve their savings goals. Ultimately, understanding these dynamics is crucial for making informed financial decisions in today’s environment.

Helpful Answers

What are some common psychological barriers to saving?

Common psychological barriers include a tendency toward immediate gratification, difficulty delaying pleasure, fear of scarcity, and a lack of clear financial goals.

How can I create a budget that effectively addresses rising living costs?

Creating a budget that addresses rising living costs requires tracking income and expenses meticulously, identifying areas for potential savings, and adjusting spending habits accordingly. Prioritize essential expenses and consider strategies like meal prepping and reducing discretionary spending.

What are some alternative investment strategies beyond traditional savings accounts?

Alternative investment strategies include high-yield savings accounts, bonds, stocks, real estate, and peer-to-peer lending. Each option carries varying levels of risk and potential return. Thorough research and consideration of individual risk tolerance are essential.

How does inflation erode the value of savings over time?

Inflation reduces the purchasing power of savings as the cost of goods and services increases. If the interest earned on savings doesn’t keep pace with inflation, the real value of the savings decreases.